“Are you mad?”, I’m sure that is what some of Buzzfeed’s well-wishers and perhaps, employees would be saying to Jonah.

In a time where success for many entrepreneurs, is defined by either going public (via an Initial Public Offering) or getting acquired by a bigger company, we still find some companies declining offers. I find it weird because one could argue that being acquired by a more successful company grants you access to their vast amount of resources and infrastructure (perhaps, one for which you were bootstrapping to pay for). Hence, doing this grants you access to the required resources to focus on your vision and potentially scale it. Also, being acquired could serve as a validation for your start-up or business. That an entity (predator) is willing to stake money in your company by acquiring it could mean you are doing something right. Else, why bother?

However, as enticing as this may sound, consenting to an acquisition inevitably means you give up control of your company. This is something Jonah Peretti is not ready to do yet. Is this the right decision for the budding digital publisher or is he putting the entire company at risk of fierce competition? In the event that some of its earlier suitors acquire a growing digital publisher and throws their weight behind that company in other to make it dominate the digital publishing market.

We have many questions just like the Business Insider Editor-in-Chief Alyson Shontell who interviewed Jonah. How did he decide to decline? Why did he decline the offer? What are his future plans for the company? When would they be actualised? What is his company’s current valuation?

In his (Jonah Peretti) own words,

There were a lot of things we wanted to do, and remaining an independent company just in my gut and my bones felt like the right path.

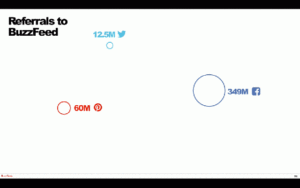

There is a lot going on for Buzzfeed at this time and I think Jonah might be up to something. They recently hired Mark Schoofs to lead their investigative journalism, alongside pushing video which is now half of their revenue. In addition to what was said in the interview with Alyson, their willingness to have their content live outside their website (digital asset) is unusual and goes against the famous practice, where the goal is to keep users glued to your website/service in order to maximise ad revenue. This could be a good play, considering they reported having 18billion impressions on Twitter, Pinterest and FB (see gif) with only a mere 2.33% leading to views on the actual site. To a digital company, impressions could equate sales.

Their numbers are pretty good as well. In 2015, NBC Universal was reported to be investing $250Million in Buzzfeed at a $1.5Billion valuation. They were reported to have turned in more than $100Million in revenue for FY2014 and $167Million for FY2015 which signified a 67 percent YoY growth for Buzzfeed. Also, they were reported to have received 200Million visitors per month in 2015.

While there is about a 30% chance of “crazy”, I will call what Jonah is doing a “play it by ear” move. Politely, letting down Disney in hopes that something meaningful would come out of Buzzfeed’s recent moves/investments.

ICYMI: Buzzfeed is a social news and entertainment focused company looking to provide the most shareable breaking news, original reporting, entertainment, and video. They brought us ‘The Dress’ – which set in motion a debate over the colour of a dress.

Now, let’s take a step back away from Jonah and think critically;

Would I sell my startup company to a company like Disney for $50M?

Of course, there is a lot to consider and in the end, you’ll be left with your guts largely influenced by data.