For the year 2019, nearly 80% of the Nigerian National Petroleum Corporation (NNPC)’s subsidiaries did not remit dividends, and anecdotal evidence from the Federal Government’s audited books for the same year suggests that huge amounts of generated revenues were unremitted by the corporation to the federation account.

As the statutory corporation charged with representing the government’s interest in the petroleum industry, the NNPC relies on aggregate revenues from its subsidiaries and business units, deductions from oil revenue due to the Federation, and third-party financing for approved projects to finance its activities. Instead of direct sales proceeds, the corporation receives a share of incorporated joint ventures (IJVs) after expenses and taxes as dividends. However, for the country’s national oil company, the amount of dividend payouts by its subsidiaries was plausibly about 11.66% of the size of the entire federal budget for 2019.

What might be the explanation?

The Dividend Payouts Gap:

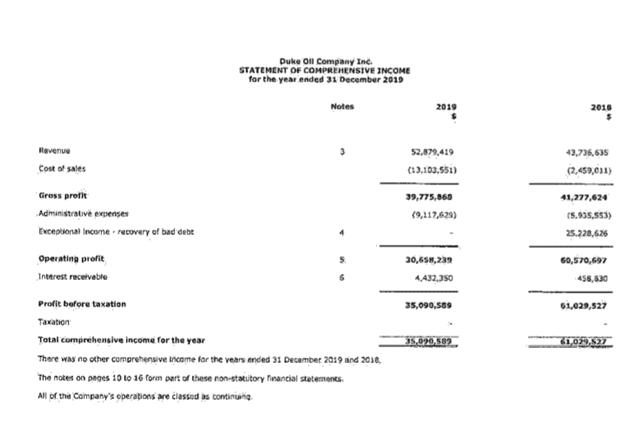

In 2019, NNPC’s international trading arm, Duke Oil Company Incorporated, generated $39.7m (₦14.3bn) in gross profits but paid NNPC no dividends for the year.

Source: NNPC 2019 Financial Statements

Other subsidiaries with no record of paying dividends in 2019 include Duke Global Energy with ₦250m gross profits, Duke Oil Services (UK) Limited, Duke Oil DMCC, Integrated Data Services Limited, Nigeria Gas Company Limited, NIDAS Marine Limited, Nigerian Gas Marketing Company Limited, NIDAS Shipping Services Limited, NIDAS Shipping Service Agency (UK) Limited, NNPC Retail Limited, NNPC Health Maintenance Organization Limited, Nigerian Petroleum Development Company Limited, Nigerian Pipelines and Storage Company Limited, Petroleum Products Marketing Company Limited, Port Harcourt Refining Company Limited, Warri Refining and Petrochemical Company Limited, and Kaduna Refining and Petrochemical Company Limited.

They recorded £99,058 (₦46.6m), ₦3m (loss), ₦15.9m, ₦79.3bn, ₦1.2m, ₦51.3bn, $2.5m, £158,252 (₦74.5m) (loss), ₦15.4bn, ₦552m, ₦439bn, ₦35.9bn, ₦14.5bn, ₦22.2bn (loss), ₦12.3bn (loss), ₦15.7bn (loss) profits respectively.

A total of subsidiaries’ dividends valued at ₦1.04 trillion went unpaid in 2019.

Table 1: Indicators of subsidiaries with no dividend payouts

| S/n | NNPC Subsidiary | Profit/Loss (₦) | Dividend Paid (₦) |

| 1 | Duke Oil Company Incorporated | 14.3bn | Nil |

| 2 | Duke Global Energy | 250m | Nil |

| 3 | Duke Oil Services (UK) Limited | 46.6m | Nil |

| 4 | Duke Oil DMCC | (3m) | Nil |

| 5 | Integrated Data Services Limited | 15.9m | Nil |

| 6 | Nigeria Gas Company Limited | 79.3bn | Nil |

| 7 | NIDAS Marine Limited | 1.2m | Nil |

| 8 | Nigerian Gas Marketing Company Limited | 51.3bn | Nil |

| 9 | NIDAS Shipping Services Limited | 2.5m | Nil |

| 10 | NIDAS Shipping Service Agency (UK) Limited | (74.5m) | Nil |

| 11 | NNPC Retail Limited | 15.4bn | Nil |

| 12 | NNPC Health Maintenance Organization Limited | 552m | Nil |

| 13 | Nigerian Petroleum Development Company Limited | 439bn | Nil |

| 14 | Nigerian Pipelines and Storage Company Limited | 35.9bn | Nil |

| 15 | Petroleum Products Marketing Company Limited | 14.5bn | Nil |

| 16 | Port Harcourt Refining Company Limited | (22.2bn) | Nil |

| 17 | Warri Refining and Petrochemical Company Limited | (12.3bn) | Nil |

| 18 | Kaduna Refining and Petrochemical Company Limited | (15.7bn) | Nil |

| TOTAL | 1.04trn | Nil |

A 2019 review of the extractive industry by the Central Bank of Nigeria (CBN) suggests a decline in the capacity utilization of Nigeria’s three refineries, indicating decreased oil production, with little room for profitability. On average, the percentage of capacity utilization of the Kaduna Refining and Petrochemical Company (KRPC), Port Harcourt Refining Company (PHRC), and Warri Refining and Petrochemical Company (WRPC) was estimated at 1.1, 7.2, and 13.3, 7.2 respectively. This shows an estimated 8.4% capacity utilization, indicating a 12.5% point decline below their 2018 levels.

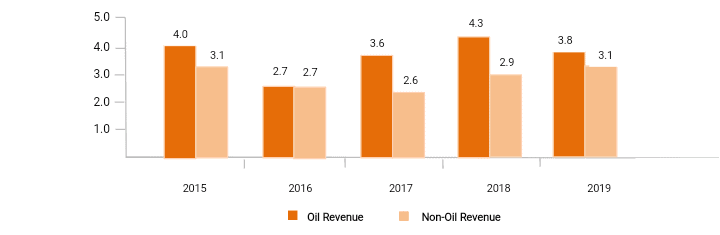

Looking at the performance of the subsidiaries, the 2019 Annual Report of the CBN also shows that while gross revenue remitted to the Federal Government rose by 6.9% of GDP, this development was not attributed to oil revenues but significant improvement in receipts from non-oil sources.

Figure 2: Oil and Non-Oil Revenue (per cent of GDP), 2015 – 2019

The Facts:

- According to NNPC data, Nigeria produced nearly 2.1 million barrels a day in 2019. And the non-functional refineries could push this number toward zero within a matter of years if their processing capacities remain under-optimized.

- The NNPC has one of the most robust remuneration packages for its directors. For a company with a steady decline in dividend remittance, such an arrangement could have significant implications for government revenues.

- The burden of unpaid dividends by NNPC’s subsidiaries is increasingly warped because the government has no comparable system for verifying income from these business units. The result is that revenues are way lower than projections and unable to finance the country’s budget.

- The stalled petroleum industry bill limits NNPC’s ability to operate accountably to be commercially viable.

- Probes initiated by the National Assembly such as investigating the alleged diversion of funds for subsidy payment and non-remittance of funds to the Federation Account are yet to lead to legal consequences for the NNPC.

What This Means:

With the unsatisfactory performance demonstrated by Nigeria’s oil industry, experts have argued that it is unreasonable to expect to receive all dividends due to the government. An industry expert, with a work history as the head of one of the country’s oil and gas regulatory agencies, has implied that the conditions under which the industry operates affect its ability to raise funds to pay dividends.

“The subsidiaries are treated together as part of the NNPC Group, which is a loss-making entity,” he said.

Furthermore, NNPC’s non-remittance of dividends signals to shareholders a certain degree of pessimism about the future of Nigeria’s oil and gas industry. The consequence is an immediate negative impact on share prices. Consistent dividends payouts will, therefore, send the right message to investors and suggest optimistic anticipations about future cash-flows in the industry.

According to Elisha Alfa, a Finance Analyst, “a company facing financial difficulties like the NNPC may always face a substantial risk of defaulting with dividend remittances and this may result in under-investment.”

The negative impact on share prices and shareholders is not the only element to take into account. Another worrying factor at play is the high remuneration for directors in the face of scarce resources. A 2018 report by Dataphyte, a media research and data analytics organization, shows that the comatose Kaduna Refining and Petrochemical Company Limited paid four directors up to ₦20 million with each directors’ monthly emoluments higher than President Muhammadu Buhari’s basic monthly salary. What could be the justification for maintaining generous emoluments for directors when cash flow generation capacity is reduced and dividends remain unpaid?

These issues raise questions about why the NNPC, with strong Presidential influence, remains susceptible to excessive non-remittance of funds to the Federation Account. Whether NNPC’s subsidiaries will one day break even again and remit generated revenues remain acute questions for several players in Nigeria’s oil and gas industry.

“On the status of 2019 unpaid dividends by NNPC, the Nigeria Extractive Industries Transparency Initiative (NEITI) 2019 independent oil/gas report is almost ready for release,” Dr. Orji Ogbonnaya Orji, Executive Secretary of NEITI, said in an interview. “NEITI’s responses on issues like unpaid dividends, taxes, grants, bonuses, and royalty are usually anchored on empirical information and data disclosed by our reports.”

NEITI has, however, expressed optimism in the mechanism it jointly set up with the NNPC. “NEITI and NNPC have established a joint committee on remediation of findings and recommendations disclosed by NEITI reports. My sense is that if unpaid dividends are disclosed in our 2019 reports when it is published, such disclosures will become an issue of attention by the joint committee. NEITI has confidence in the work of the joint committee because a lot, much more have been achieved through this process in the past,” Dr Orji added.

NNPC’s spokesperson, Dr. Kennie Obateru, was not immediately available to comment on the issue.

This story was produced under the NAREP Oil and Gas Media Fellowship of the Premium Times Centre for Investigative Journalism.