Cypto giant FTX has filed for bankruptcy after being hit with over $5 billion worth of withdrawals. While conspiracies have stirred over the possible cause of the scandal, our findings are that the entire setback is a product of a bad business choice from the crypto firm.

Before the entire chain of events leading to the firm going bankrupt, FTX was a crypto giant. With millions of users and investors from across the globe, the company may have thought it could get away with its “carelessness.” According to insiders familiar with the matter, a shady business deal between the crypto firm and its sister company led to its downfall.

The said deal involved FTX funding a possible trading venture with its sister company, Alameda Research. Details on the trading venture are still sketchy, but the problem was not solely with funding Alameda. The main issue is where the funds for this “trading venture” were got from, the everyday traders using FTX.

Dragging the users into a bad trading venture between FTX and Alameda Research

Digging deeper into the matter, we can see that the crypto trading firm gave over $10 billion worth of customer assets to Alameda for business purposes. Well, the business didn’t turn out successful, leaving the crypto firm with only $6 billion worth of customers’ assets. The events of this loss leaked to users of the FTX platform from across the globe, who in turn began requesting funds withdrawal.

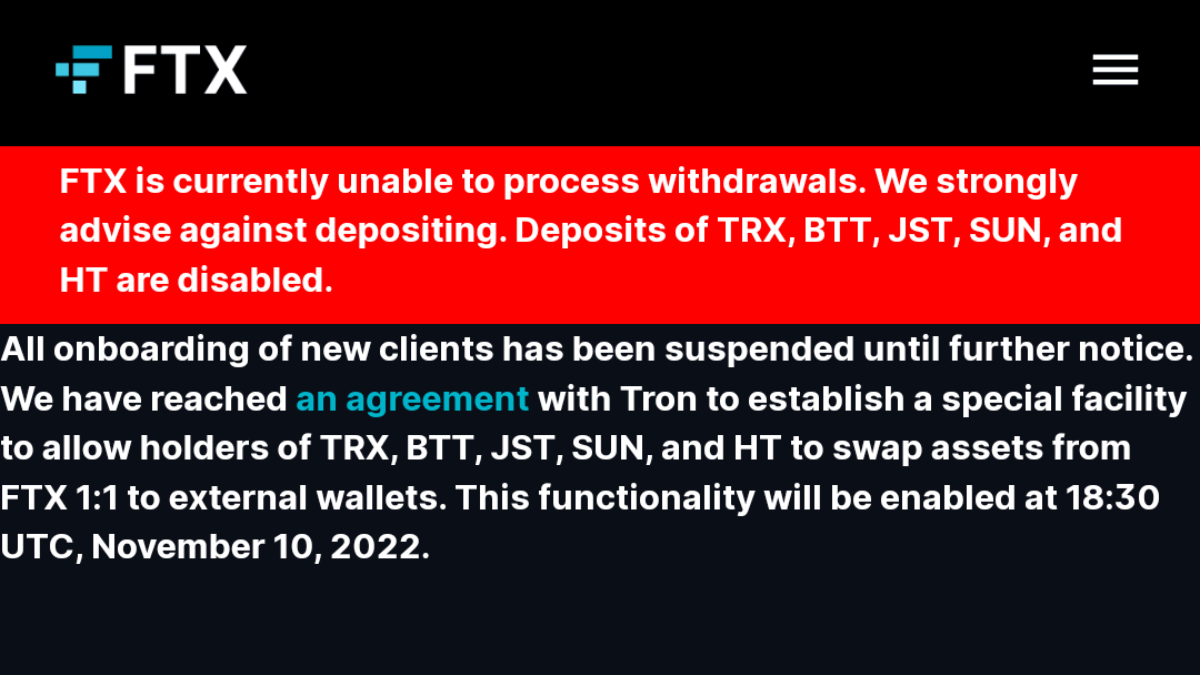

Within the week FTX got hit with over $5 billion worth of withdrawal requests prompting them to suspend withdrawals hence locking users’ access to their money. Backstage, the firm began scrambling for a way out of the mess it put itself in, leading them to turn to their major rivals. Offering to sell itself to Binance was a possible solution to the standing issues, but the latter had no interest in buying. According to Binance, FTX’s problems are “beyond our ability to help.”

Just recently, the founder and CEO of FTX, Sam Bankman-Fried, stepped down from his post. The firm will continue to fight hard to remedy the situation and possibly bounce back soon. We still wait for more updates regarding the money of millions of customers and whether they will get a form of refund.