More than 445,000 barrels of combined daily oil-processing capacity has been cut in the wake of Nigeria’s idle oil refineries. The refineries continue to record billions of naira in operating costs despite their inability to process petroleum products. In the fourth quarter (Q4) of 2020, all three refineries incurred an operating deficit of ₦19.7bn without refining any crude oil.

In Q4 2020, Kaduna Refining and Petrochemical Company (KRPC) recorded deficits of ₦1.5bn, ₦1.46bn, and ₦2bn in October, November, and December, respectively. In the fourth quarter, the total operating deficit for Port Harcourt Refining Company (PHRC) stood at ₦5.72bn, while the deficit recorded by Warri Refining and Petrochemical Company (WRPC) was ₦8.96bn.

Table 1:

Source: NNPC’s Monthly Financial and Operations Report

However, to ensure the distribution of Premium Motor Spirit (PMS) across the country in the short term, the Nigerian National Petroleum Corporation (NNPC) sold 152.83 million barrels of crude oil. International Oil Companies (IOCs), as well as Independent Sources, contributed 67.63% to the total sales. The Corporation also supplied 5.63 billion litres of petrol through Direct Sales Direct Purchase (DSDP) in the last quarter of 2020 for domestic utilization, while it sold 5.21 billion litres of white products.

In the same quarter, $122.22m and N441.33bn were remitted to the Federal Accounts Allocation Committee (FAAC) from both the dollar and naira payment, respectively. Remittances were made from crude sales of $1.95bn in October, and $2.15bn and $1.72bn in November and December, respectively. This includes 17.81 million barrels of crude oil from the Nigerian Petroleum Development Company Ltd. (NPDC), a subsidiary of NNPC. The total crude oil sale in Q4 2020 was $5.83bn.

The Pipelines and Product Marketing Company (PPMC) generated revenue of N 672.88bn. PMS revenue amounted to an impressive 99.64%, while Kero and Diesel generated 0.02% and 0.34%, respectively.

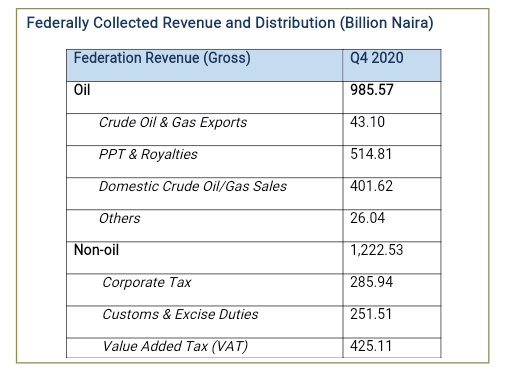

Table 2:

Source: CBN Economic Report, Fourth Quarter

According to the Central Bank of Nigeria (CBN), federally collected revenue amounted to N2,208.10 billion, with oil and non-oil revenue sources contributing 44.6% and 55.4%, respectively.

The Disruptions to Refinery Operations

Over the years, to increase capacity in the long term, the NNPC carried out cost-intensive periodic turnaround maintenance on the oil refineries. Yet, crude oil production kept declining as the decades-old and poorly-maintained refineries continued to record zero revenue.

In its December 2020 monthly report, NNPC attributed the current declining operational performance to ongoing revamping efforts on the refineries. The Corporation expects these efforts to improve capacity utilization upon completion.

In April 2020, the NNPC’s Group Head, Mele Kyari, had announced the Corporation’s decision to shut down all its oil refineries. This was in a bid to secure funding and a model to upgrade the refineries.

According to Kyari, “…after proper scoping, which was not done in the past, we know exactly what to do to get them back on stream.” He added that the NNPC was considering “a different model” for the oil refineries, which included the type used by Nigeria LNG.

In addition to the failure of the oil refineries, Nigeria’s oil and gas sector is plagued with operational deficiencies, corruption, pipeline vandalism, and theft of petroleum products. NNPC’s report indicates that there were 101 pipeline breaks in Q4 2020. In October 2020, 23 pipeline points were vandalized, while 35 and 43 points were recorded in November and December, respectively. ₦8.08bn was, however, spent on repairing and managing pipelines in Q4 2020.

Refining and Processing: The Way Forward

As Nigeria contends with shrinking oil production levels due to inoperative refineries, opportunities for increasing oil exports dry up as well. According to industry experts, the country needs to invest heavily in its own domestic downstream infrastructure to minimize the current oil import growth and provide opportunities for exporting refined oil products.

An energy expert, David Ali, with experience in matters involving energy, oil and natural gas, refining, and petrochemicals, is of the opinion that revamping the three oil refineries may not necessarily increase their capacity.

“I think the oil and gas industry is still somewhat in a fog and needs to be absolutely sure about how things should go with the refineries,” Ali says.

He added that “given the consistent under-performance of the operations of the refineries, they should either be entirely overhauled or sold.”